Oil Price Could Rise to $100, Due to the

Deepening Iranian Crisis and Falling Canadian Rig Count

By Nick

Cunningham

Oilprice.com, Al-Jazeerah, CCUN,

January 4, 2018

|

|

|

|

|

|

Iranian students protesting at the University of Tehran,

December 30, 2017 |

Iranian Crisis Could Send Oil to $100

Oil prices started the year on a high note as some geopolitical

tension pushed aside bearish concerns. Both WTI and Brent opened above

$60 per barrel for the first time in years.

The protests in Iran were the main driver of the bullish sentiment in

the oil market. Anti-government demonstrations swept across the country

in recent days, and unlike the widespread protests in 2009, the current

rallies are related to economic woes and are also taking place in more

cities than just Tehran. “Growing unrest in Iran set the table for a

bullish start to 2018,” the Schork Report

said in a note to clients on January 2.

At least

14 people have been killed in the protests and an estimated 450 have

been arrested. It is the most serious challenge to the Iranian

government in years, and Iran’s Supreme Leader put the blame on foreign

agents, presumably the United States. “In recent days, enemies of Iran

used different tools including cash, weapons, politics and intelligence

apparatus to create troubles for the Islamic Republic,” Ayatollah Ali

Khamenei said.

Meanwhile, tension over North Korea – although not a new development

– could be spreading to include a spat between the U.S. and Russia as

well as the U.S. and China. Reuters

reported late last week that Russian oil tankers have sent fuel to

North Korea on multiple occasions in the last few months by transferring

cargoes at sea. If true, the actions would amount to a violation of UN

sanctions. Sources told Reuters that there is no evidence that the

Russian state was involved, but the news has raised the specter of

U.S.-Russian tension as Washington seeks a hard line on Pyongyang.

Related: Oil Sees Strongest Start Of Year Since 2014

The spat over oil shipments to North Korea is also centered on China.

South Korea

seized two ships that were allegedly carrying oil to North Korea.

The U.S. has been trying to get the UN Security Council to blacklist a

number of ships suspected of sending oil to North Korea, but China has

resisted such efforts. The incident has raised suspicion in Washington

that China is circumventing UN sanctions and providing a lifeline to

North Korea.

The two geopolitical flashpoints seemed to outweigh bearish concerns

over the

return of the 450,000-bpd Forties pipeline to operation. The key

North Sea conduit came online in recent days, restoring disrupted North

Sea oil to the market. Libya also

repaired an oil pipeline that funnels crude to its Es Sider export

terminal, easing concerns about disrupted supply. The expected return of

supply from both countries has been cited by analysts as reasons to

expect a selloff in crude prices at the start of the year, but so far,

the tensions in Iran and North Korea have carried the day.

With that said, the odds of a tangible disruption from these

geopolitical events is minimal. “I don’t think we’re seeing much

immediate risk from these [Iran] protests which are taking place in

urban areas but I think it’s the backdrop—both political and in the oil

market—that mean these are catching attention,” said Richard Mallinson,

analyst at consultancy Energy Aspects, according to

the WSJ. “Geopolitics is going to be much more in focus now that

we’re in a tighter market.”

Related: U.S. Shale Can’t Offset Record-Low Oil Discoveries

But Iran’s oil fields are located far away from any serious impact

from the demonstrations. “As of yet there is no deep seated concern for

a disruption of Iran’s 3.8 mb/d crude oil production,” Bjarne Schieldrop,

chief commodities analyst at SEB, said in a statement. “However, if it

was to happen it would have a huge impact on the global crude oil

prices. A full disruption of such a magnitude would immediately drive

the Brent crude oil price above the $100/bl mark.”

As concerns of a supply disruption from Iran start to wane, as seems

likely, the focus will shift back to the fundamentals. The IEA, among

others, predict a return to inventory builds in the first and possibly

second quarter of this year. Also, investors have racked up an extremely

lopsided bet on crude futures, and such levels of bullishness tend to

precede a selloff. That means that as these geopolitical events lose

salience, the short run risk for oil prices is very much on the

downside.

“Not having at least one solid correction to the downside in 2018

with such a mega bullish allocation to start with would probably be the

biggest surprise of all this year,” Schieldrop added.

***

What’s Behind The Canadian Rig Count Crash

By

Nick Cunningham - Jan 03, 2018, 6:01 PM CST

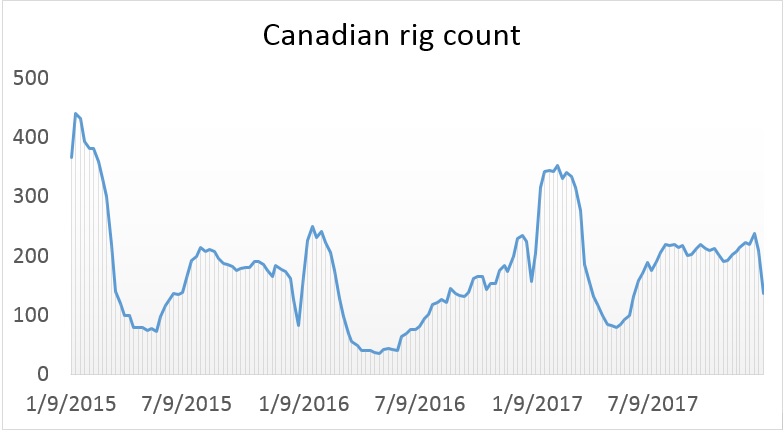

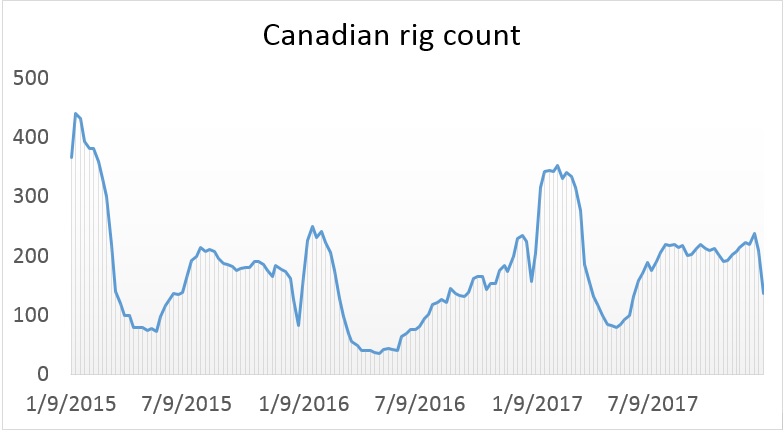

The U.S. rig count has been on the rise for months, despite some

recent hiccups, but Canada’s rig count recently plunged amid low oil

prices.

Canada’s rig count fell from 210 to 136 for the week ending on

December 29, a massive drop off. That took the rig count to a

six-month low. Obviously, the losses were concentrated in Alberta,

where most of the rigs tend to be. Alberta’s rig count sank from 162

to 118 in the last week of 2017. But Saskatchewan also saw its rig

count decimated—falling from 43 in mid-December to just three at the

close of the year.

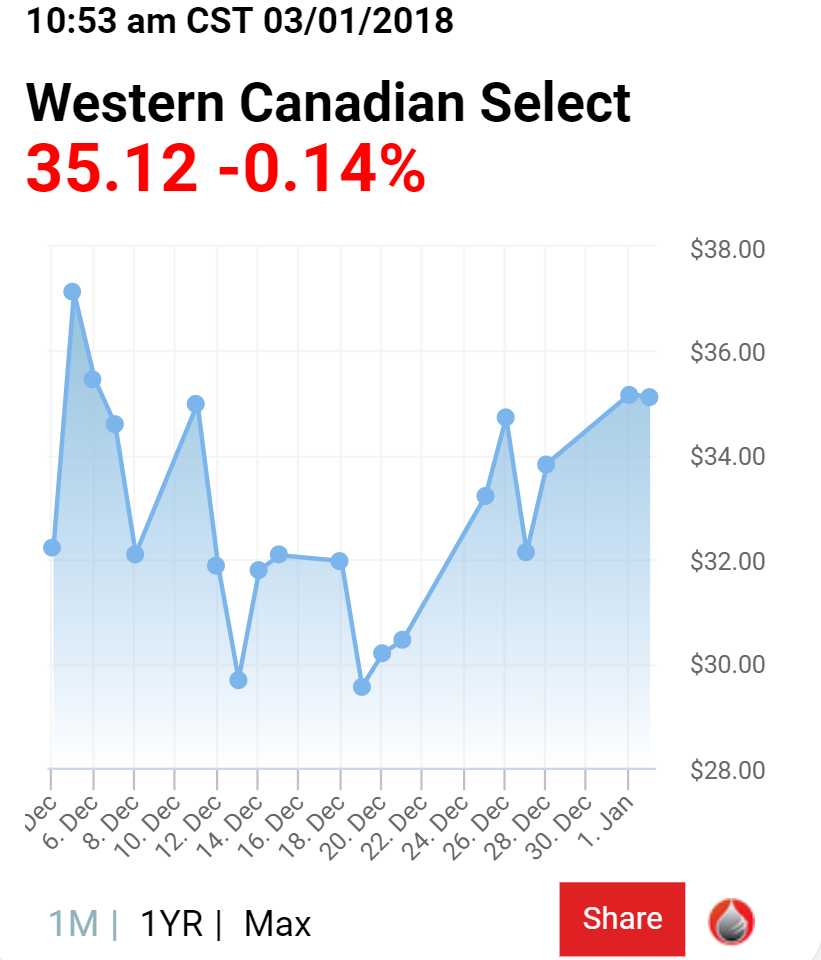

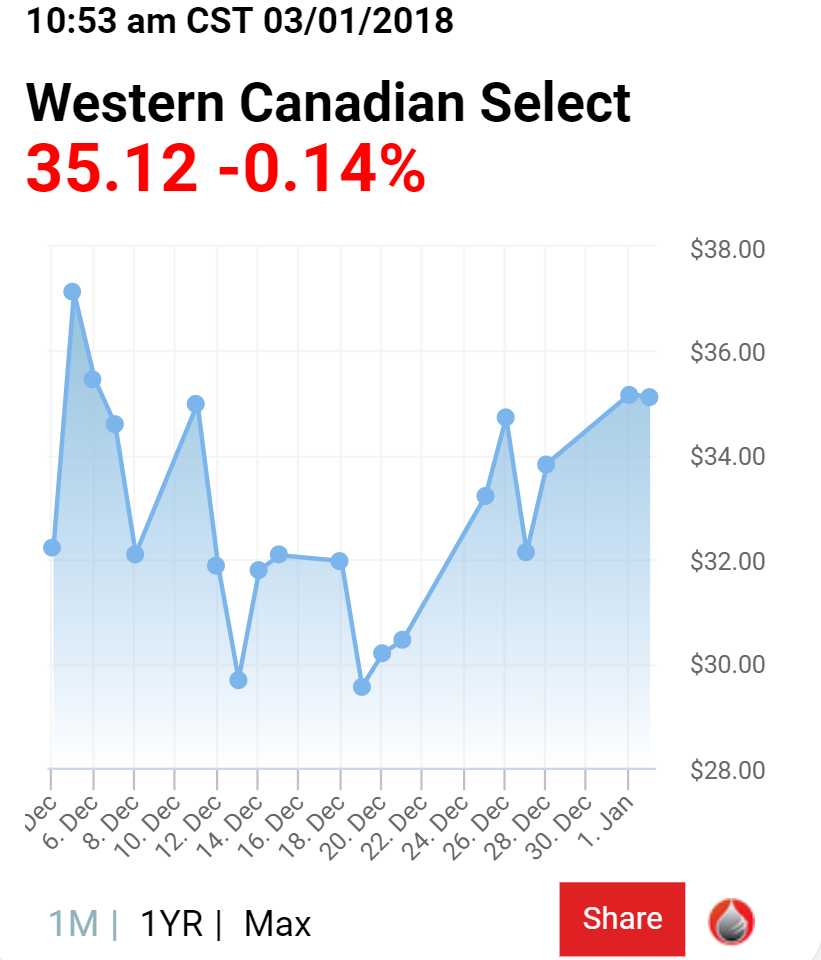

The losses can likely be chalked up to the meltdown in prices for

Canadian oil.

Western Canada Select (WCS), a benchmark that tracks heavy oil

in Canada, often trades at a significant discount to oil prices in

the United States. But the WCS-WTI discount became unusually large

in November and December for a variety of reasons. The outage at the

Keystone pipeline led to a rapid buildup in oil inventories in

Canada, and

storage hit a record high in December.

Also, Canada’s oil industry has been unable to build new pipelines

to get the landlocked oil from Alberta to market. Alberta oil

producers are essentially hostage to their buyers in the U.S., and

with oil production now bumping up against a ceiling in terms of

pipeline capacity, the glut is starting to weigh on WCS prices.

In December, Enbridge

announced that it will ration the space on its Mainline oil

pipeline system for January as Canada’s pipelines are essentially at

full capacity. Enbridge said that it will apportion lines 4 and 67,

which move heavy crude, by 36 percent. The term “apportionment” is a

euphemism for rationing—essentially oil producers are unable to get

all of their product onto the pipeline and are hit with

restrictions. That means the oil has to be diverted into storage.

In short, there’s somewhat of a glut of supply in Canada right now.

The problem is that there’s little prospect of a solution in the

near-term. Railroads, although they are taking incrementally more

cargoes, cannot handle the excess supply all on their own,

especially with new supply coming online. And there are no serious

pipeline capacity additions expected for about two years at the

earliest. The three main proposals—Kinder Morgan’s Trans Mountain

Expansion; TransCanada’s Keystone XL; and Enbridge’s Line 3

replacement—all face legal questions and uncertain completion dates.

On top of that, Canada’s oil sands producers are adding new supply.

At today’s prices, it makes little sense to greenlight new upstream

projects, particularly in expensive oil sands. But there are still

some projects that are finishing up that were given the go-ahead

years ago when oil prices were substantially higher. Suncor Energy

is set to bring its Fort Hills project online, which will add nearly

200,000 bpd of new supply within 12 months.

That all means that the pressure on WCS probably won’t go away. The

price meltdown from two months ago is probably now showing up in the

rig count. The U.S. typically sees the rig count fluctuate in

response to changes in the oil price by several months, and the rig

count in Canada will only now start to reflect the price plunge from

months ago. The rail industry might handle more oil cargoes, which

could help push up WCS a bit, but the larger-than-usual discount

might persist for some time.

Canada could add new refining capacity to process all of that oil

right at home, an option that is often raised when WCS prices tank.

IHS Markit recently

studied several scenarios for Canada’s oil industry, including

upgrading existing refineries to process heavy oil into a lighter

synthetic form of oil, as well as building entirely new refineries.

IHS Markit concluded that there is an opportunity to convert

existing refineries, but that the abundance of light oil supply in

North America could challenge the economics. New refining capacity

is a risk. In any event, refined products and lighter oil would

still need to be exported via pipeline.

In short, Canada’s oil industry faces more obstacles than, say, the

much-watched shale drillers in the United States. The U.S. rig count

is closely tracked around the world for clues into what happens next

in the oil market—an increase is assumed to mean that more U.S.

shale supply will be forthcoming while a decrease is a sign of

market tightness and potentially higher prices. The publication of

this weekly data has global implications.

Canada’s rig count, on the other hand, could continue to struggle

even as U.S. shale drillers spring into action in response to higher

prices. Canadian producers won’t benefit as much from the upswing in

the global market due to their local and regional problems, mostly

related to the lack of pipeline capacity.

https://oilprice.com/Energy/Crude-Oil/Whats-Behind-The-Canadian-Rig-Count-Crash.html

**

Share the link of this article with your facebook friends